Irs Schedule B 2024 – The due date to file an updated Income Tax Return (ITR-U) for 2021-22 is declared as 31st March 2024. The Income Tax Department of India has tweeted to alert the taxpayers regarding the approaching . Additionally, the third instalment of advance tax for the assessment year 2024-25 is also due on this date. Furthermore, several TDS certificates for tax deducted in October 2023 are also required to .

Irs Schedule B 2024

Source : hub.jhu.edu

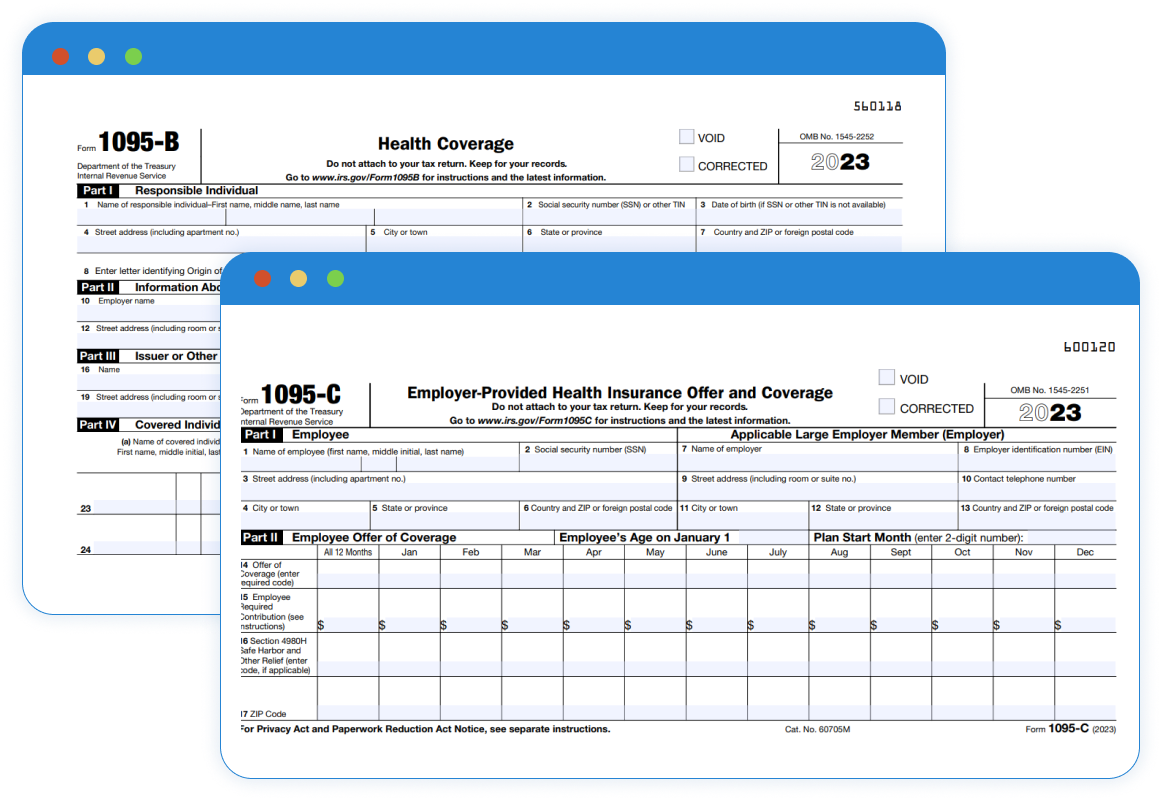

The IRS Releases Final Version of Form 1095 B & 1095 C for 2023

Source : www.acawise.com

IRS sets 2024 contribution limits for 403(b) plans | Hub

Source : hub.jhu.edu

IRS Refund Schedule 2024 Date to recieve tax year 2023 return!

Source : www.bscnursing2022.com

3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov

Business tax deadlines 2024: Corporations and LLCs | Carta

Source : carta.com

3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov

IRS to Require Electronic Filing for ACA Reporting in 2024

Source : www.newfront.com

Form 1040 for IRS 2023 2024 ~ What is it? Schedule A B C D

Source : www.incometaxgujarat.org

Schedule B (Form 1040) Guide 2023 | US Expat Tax Service

Source : www.taxesforexpats.com

Irs Schedule B 2024 IRS sets 2024 contribution limits for 403(b) plans | Hub: US Self-Employment Tax 2023: It is common for self-employed people to have more freedom and control over their profession or business. It also implies that they can no longer rely on their employer to . From TDS deposit to TDS/ TCS certificates and challans to advance tax to audit report; here’s the complete list of activities you should complete in December .